Estate Planning

For more than a century, Indian families have seen valuable land resources diminish as fractionated ownership increases with each passing generation. ILTF supports estate planning as one of the most effective ways to stop the continued division of Indian land titles and ensure that Indian lands are controlled and managed by Indian people. Over the years, ILTF has funded projects that provide education and free estate planning services for tribal members across the Pacific Northwest, Oklahoma, North Dakota, South Dakota, Minnesota, and many more places. As a result, more than 3,500 landowners have received direct legal service and will writing assistance. In addition, more than 7,500 people, including elected tribal officials, landowners, attorneys and Indian land heirs have received training through ILTF-funded estate planning programs.

Helpful landowner resources

ILTF has visited countless tribal communities in recent years to provide landowner information on estate planning and will writing. Since 2020, the COVID-19 pandemic has halted all travel in order to protect the health and well-being of elders and others in the community. As a result, ILTF has now developed a series of online resources to help Native American landowners, individual agricultural producers and tribal leaders to better manage their land.

Town Hall meetings

ILTF hosts Town Hall-style meetings online where subject matter experts will answer questions and help participants to better understand important land issues. ILTF invites landowners and agricultural producers to offer information on the problems they face along with potential solutions that could help others in Indian Country. Information on upcoming Town Hall meetings will be distributed by email and posted here.

LANDOWNER INFORMATION

The following information for landowners is organized by the date it was distributed via email. Please email info@iltf.org if you would like to be added to the distribution list.

Economic Development on Allotted Lands

There are many barriers in place that make it difficult for Indian landowners to use their lands to benefit their economic ambitions, but it’s not impossible to build a successful business on allotted lands. It’s important for landowners to understand the rules and regulations imposed by the federal government and Tribal nations. This primer looks at what the legal framework means for business and/or land transactions and taxes related to the income generated by that economic activity.

What is economic development?

Economic development refers to policy decisions made by government leaders designed to promote positive changes in financial growth for the community and its individual members. The legal framework created by laws, codes and regulations of the tribe and federal government affects agricultural producers, other small business owners, and landowners looking to take advantage of their trust and restricted-fee assets. It is critical for these stakeholders to understand the rules because ultimately there is no alternative to private sector investment to achieve effective economic growth.

Community Planning

Community planning involves the formulation of a long-range vision for the future. Once the vision can be described, community leaders and the government set goals and policy strategies for achieving social and economic development. Ideally elected leaders will also look to incorporate environmental sustainability into their decision-making process. Implementing community planning requires the significant guidance as well the establishment of limitations on what can be done by landowners and businesses. Here is a brief list of the types of laws and regulations that can have an impact on community and economic development:

- Zoning

- Land use codes

- Business regulations

- Finance and tax codes

- Supportive government structures

There are more restrictions in conducting economic development, business growth and exercising land ownership in Indian Country because of the fiduciary responsibilities of the U.S. government. The role of the federal government in landownership complicates simple transactions and can add a significant amount of time and energy to reach business goals.

There are two national efforts crafted to increase tribal understanding of development in Native American communities. The first is the Harvard Project on American Indian Economic Development. The Native Nations Institute, an outgrowth of the Harvard Project located at the University of Arizona, assists tribal leaders in building capable Native nations that are able to effectively pursue and realize their own political, economic and community development objectives. Both of these organizations offer a variety of resources on their websites. organizations.

Business Development

There are plenty of resources offered by government and universities for understanding and building businesses. The basics to know include:

- Defining the “corporate” form

- Assembling a team of business professionals such as an accountant or FSA agent

- Collecting start-up/operating funds

We’ve shared a few resources below to help businesses and individual landowners begin the process of business development in Indian Country.

Taxation

This is a topic that holds great importance to tribal businesses but is probably not understood well enough by landowners and their businesses. There are three factors that need to be identified to determine if there is an exemption from either state or federal income taxes:

- Individual seeking an exemption

- Location of business activity

- Type of business activity

Businesses and individual Indian landowners should have at least a basic understanding of the Supreme Court decisions Squire vs Capoeman (1956) and Bryan vs Itasca County (1976) when discussing their tax situation.

Additional Resources

Department of the Interior – Indian Affairs: Division of Economic Development

Business Codes for Tribal Economic Development

Income Tax Guide for Native American Individuals and Sole Proprietors (September, 2020)

Message Runner #9: Managing Land in a Highly Fractionated Future

Iowa State University Extension and Outreach: Ag Decision Maker Resources This website offers resource tools and reference articles for farmers and ranchers including:

_______________________

The Basics of Indian Realty: A refresher

Begin with the basics. Given the complex nature of the laws and regulations regarding Indian land, it’s important for landowners to have a firm grasp on the basic building blocks before tackling the transactions and processes involved. This primer should help Indian landowners learn more about how to make the most of this unique asset that is so valuable to families and tribal economies.

Let’s begin with the legal differences between land, real estate and realty, three terms that are used a frequently when discussing Indian land:

- Land – The earth’s surface to the center of the earth along with the air space above the earth, including natural features like trees and water

- Real estate – Land plus permanent human-made additions like buildings and fences. (This was legally changed by Congress for Indian lands and will be discussed below.)

- Realty – Also known as Real Property, realty is real estate plus a bundle of legal rights of ownership

GOVERNING JURISDICTION

In its simplest form, ‘jurisdiction’ is the exercise of sovereign authority by a government over territory within its national borders. Government laws establish the structures of what can be legally done on/with private land and also create either opportunities or obstacles for landowners to reach their goals. Two applications of civil jurisdiction used by the government over landowners are property taxes and zoning regulations. Here is a general list of land tenure and jurisdiction issues that landowners may need to consider in using land in a reservation community:

- Tribe

- Bureau of Indian Affairs (BIA) (Federal)

- Allotment landowner

- Tribal member

- Non-Indian

- State

- County

- Town/City

Concurrent jurisdiction is common throughout Indian Country. With shared authority, one government entity may have supreme jurisdiction over the other. When dealing with Indian land issues it’s important to understand the case law governing a given situation. When a question of appropriate jurisdiction occurs, and there isn’t clear agreement between governments, the two parties often end up pursuing their sovereign interests in court. (Scroll down to the resources posted on Jan. 17, 2022, for a more thorough discussion of case law.)

PROPERTY TYPES

The first issue to cover for property types in Indian Country is ‘title’ which has two meanings: 1. Evidence of ownership by a deed or 2. Ownership of the land as represented by the owner’s bundle of rights.

- Fee – The title holder is entitled to all rights to the property. These rights are usually limited only by public and private restrictions, such as zoning and restrictive covenants. When the landowner dies, the rights to the land pass to the owner’s heirs. In the context of Indian lands, the owner has the right to encumber (assign the property rights) or sell the property without federal interference.

- Restricted Fee – Title is held by the tribe or individual Indian landowner, subject to restrictions. Those rights limit the ability of the landowner to encumber or alienate the land without federal approval.

- Trust – Title is held by the United States government for the benefit of the tribe communally or for an Indian individually. All rights bestowed by title belong to the federal government. Beneficial owners face restrictions on the use of any bundled right without federal approval.

Congress used statutory law in 2008 to change the nature of Real Estate to address a federal problem with environmental contamination and remediation. Through the Act, permanent improvements are no longer considered trust assets. Click here to see a pdf version of the Permanent Improvements PowerPoint presentation.

Another key issue with trust land is the direct beneficial ownership form. Beneficial title is held by individuals as joint tenants or as tenants in common. Both provide the owner with the right to use or make decisions for the whole property, not just a specific piece of it. Click here to see a pdf version of the Joint Tenancy PowerPoint presentation.

BUNDLE OF RIGHTS

The Bundle of Rights is a concept in realty that is derived from old English law. A key concept of that law allowed rights to be separated and transferred individually or used by a landowner. The person, people or government who hold title to the real estate also owns these rights.

- Right of Possession – The right to use the property

- Right to Control – The right to do with the property as you wish

- Right of Enjoyment – The right to benefit from your property as long as you are not doing anything illegal

- Right to Exclusion – The right to keep others from entering your property

- Right of Disposition – The right to sell, devise (a will) or encumber (lease or easement) the property.

For a longer discussion of the Bundle of Rights, as well as information on the major differences of those rights for Indian land, please click the PowerPoint presentation below. [Bundle of Rights PPT]

Click here to watch a video of ILTF’s Realty 101 Town Hall recorded on Feb. 22, 2022

Additional Resources

- Message Runner #1: An overview of the major Indian land tenure issues

- Tribal Lands: An Overview [a publication of the Congressional Research Service]

- Bundle of Rights presentation (a pdf version of the PowerPoint presentation)

———-

November 15, 2022

Valuations: What’s the difference between an appraisal and a valuation?

Nearly every land transaction in Indian Country requires an appraisal of the land and/or its resources. The U.S. Department of the Interior (DOI) uses those appraised values in processing applications for sale, leases, rights-of-way, land exchanges, trespass, probate and other types of transactions. With a backlog of work that can cause an appraisal to take more than a year to complete, what alternatives do landowners have to reach their transaction goals? This primer will discuss what a valuation means for the federal government and how it may benefit landowners moving forward.

Appraisal

An appraisal is a written statement, independently and impartially prepared by a qualified and certified appraiser, that provides an opinion of defined value of a described property as of a specific date, supported by the presentation and analysis of relevant market information. (43 CFR 100.100)

An appraisal is prepared in accordance with the Uniform Standards of Professional Appraisal Practice (USPAP), a guide that includes standards for all types of appraisal services including real property, personal property, business valuation and mass appraisal. The purpose of USPAP is to promote and maintain a high level of public trust in appraisal practice by establishing requirements for appraisers. The takeaway is that appraisals are defined by regulation and held to the highest professional standards, which allows the Bureau of Indian Affairs (BIA) to use them to fulfill its fiduciary obligation to tribes and allotted landowners.

Valuation

Valuations accomplish many of the same goals as an appraisal but may not always follow a defined set of standards. That limits the ability of the BIA to use valuations for many transactions. A valuation is a general estimate of value that is created by a survey of past land transactions. A market analysis surveys rental or sales information in a local area, including the results of a competitive bidding process for leases or permits. The market survey will often suggest a range of values that may apply to similar transactions.

Valuations are used by the BIA when allowed by law or regulation. They require appraisers to develop a satisfactory process to ensure that due diligence was provided to tribal land beneficiaries. Mass appraisals are defined in USPAP and were included in the Land Buy-Back Program for Native Nations. The mass appraisal process is used to establish the fair market value of various types of lands and improvements and make offers to landowners to purchase interests in trust or restricted land.

Valuations are also used in Indian agriculture. A BIA Agency Superintendent has the authority to set permitting rates (AUM rates) for the grazing of allotted lands. Annual rental rates are established through ag producer surveys collected by the National Agriculture Statistics Service (NASS) and determined by competitive bidding, appraisal or any other appropriate valuation method.

Valuation as a tool for landowners

The limits on how valuation is used for standard Indian land transactions make it a slow process. If the use of valuation was expanded for more general transactions, it would free up limited resources that could be better used for transactions that do require a direct, professional assessment of price or value. Reservation-level land value schedules would add to the data available to landowners and tribal leaders to use in managing their land resources. The use of a valuation for simple and uncontested probates would also speed up the resolution of these cases for Indian families. Where there is little concern for the financial value of trust assets in the probate, a valuation provides heirs with a general idea of value but does not make them wait a year or two to receive their loved one’s land interests.

Additional Resources

- 25 US Code, Chapter 24, Indian Land Consolidation, Section 2214: Establishing Fair market value

- 25 CFR, Section 162.211

- Agricultural and Rangeland Management Handbook (July 14, 2021) (See page 28: Determine applicable grazing rental rates)

———————-

October 20, 2022

Ag Leasing and Grazing Permits: Basic information for landowners and a discussion on Indian Preference

When we say ‘Indian agricultural land’ what we mean is Indian land, including farmland and rangeland, that is used for production of agricultural products or occupied by industries that support the agricultural community. This is true regardless of whether there has been a formal inspection or land classification done.

To the uninitiated, there may not seem to be much of a difference between an agriculture lease and a grazing permit. This topic is intended to first address the question regarding the difference between the two land uses and then look at the impact of Indian Preference on the agricultural environment.

Ag Leasing Refresher

Back in September of 2021 we took a look at agricultural leasing as a topic. As a refresher, the Long-Term Leasing Act of 1955 structured the rules of leasing for more than 40 years, until the American Indian Agricultural Resource Management Act (AIARMA) was passed in 1993. The regulations surrounding ag leasing were not changed to reflect updates in AIARMA until CFR Part 162 added Subpart B in 2001. The regulations of Subpart B, as well as the steps in processing an agricultural lease (Procedural Handbook), are linked below.

Key provisions of the law and regulations include:

- Maximum lease term of 10 years; 25 years if “substantial investment” is required

- Regardless of length, rent adjustments are required every five years

- Legally adopted “best interest” and “market rent” standards

- All ag leases must be recorded

- Written objection by majority ownership of allotted lands authorizes emergency actions to protect ag resources as needed to address holdover, unauthorized use, and resource damages

Grazing Permits

While an agricultural lease defines a possessory interest in farm or pasture land, the grazing permit meets a different need in agriculture production. A grazing permit is a written contract/agreement with the Indian landowner to use trust land and restricted-fee land for harvesting of foliage by livestock. The permit is a revocable privilege, which also means the user has different rights than lessee.

Grazing permits will specify essential requirements for use of the land, such as:

- Authorized users, range unit number/name, applicable tribal jurisdiction

- Kind of livestock, grazing capacity, animal identification requirements, season of use

- Rental rate, payment schedule, payment method

- Usual permit term of 10 years; 25 years if “substantial investment” required

- Any conservation measures to preserve the integrity of the land.

The Bureau of Indian Affairs (BIA) is responsible for securing landowner consent to use allotted lands within range units. Under the authority of the AIARMA, tribes retain the right to establish a comprehensive agricultural management plan to effectively protect and promote ag activities throughout the reservation. The tribe will often work with BIA to establish management units, grazing capacity, grazing rental rates, and allocation criteria. Once the boundaries are established, the tribe and BIA will advertise the permits for bid. Detailed steps in the process are available for review in Chapter 4 of the Agricultural and Rangeland Management Handbook (linked below).

Indian Preference vs Open Bid

Unless prohibited by federal law, the BIA will recognize and comply with tribal laws regulating activities on Indian agricultural land, including tribal laws relating to land use, environmental protection and historic or cultural preservation. Grazing rules and requirements passed by tribal governments for use on tribal lands may also be applied to individually allotted lands. However, landowners can exempt their lands from tribal policies as outlined in 25 CFR 166.101. In order to do that, landowners need to provide written notice to the BIA Agency Superintendent.

This is a critical issue when the tribal nation implements policies to promote local Indian agricultural efforts. While “open bid” is a straight-forward process employed by the BIA to solicit bids from everyone to meet or exceed the fair rental rate, “Indian Preference” necessarily limits the available audience/bidders for a grazing permit. Linked below, the Ordinance 71 – Grazing by the Cheyenne River Sioux Tribe – limits the issuance of a grazing permit to a resident Tribal member who is 18 years or older. The process still allows for competitive bidding but does not allow outsiders and non-Indians access to agricultural lands for grazing purposes. The ordinance also assesses an additional fee for non-member cattle grazed as part of any permit.

The balance between promoting opportunity for Indian farmers and ranchers can be at odds with pursuit of earning the most revenue for Indian allotted lands. There are positives and negatives to both strategies. The more landowners and tribal leaders know about the process the better they can meet their own needs.

Additional Resources

BIA Ag Resources

- CFR 25, Part 162, Subpart B – Agricultural Leases

- Agricultural Leasing Procedural Handbook (March 6, 2006)

- CFR 25, Part 166 – Grazing Permits

- Agricultural and Rangeland Management Handbook (July 14, 2021)

Other Ag Resources

- Cheyenne River Sioux Tribe Ordinance 78 – Ag Leasing Farm Pasture

- Cheyenne River Sioux Tribe Ordinance 71 – Grazing

- Cheyenne River Sioux Tribe Consent of Owners of Farm Pasture Lease – Opt Out

______________________

August 24, 2022

Mapping for Landowners

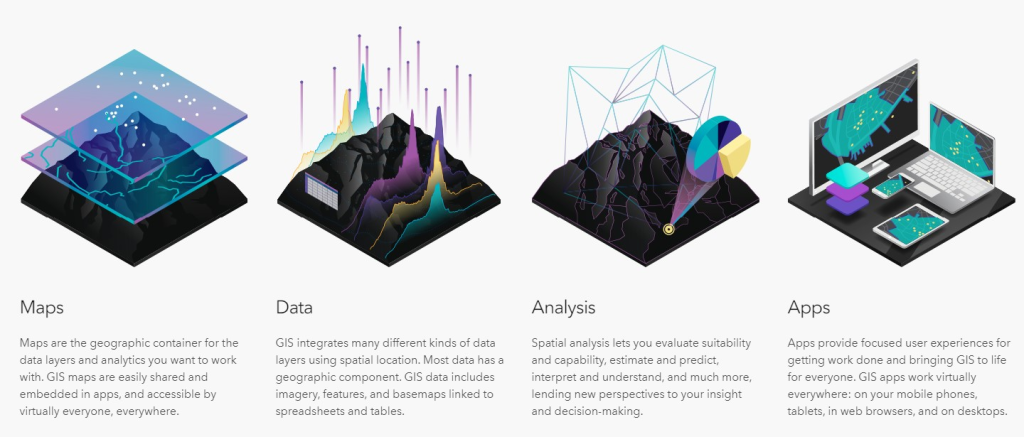

Maps are a critical tool to help people communicate by sharing data related to places in the world. Maps and GIS also help people to better understand patterns, relationships, identify geographic context, and set priorities. The information presented here is designed to help landowners better understand maps, online mapping tools and how maps can improve landownership.

The language of mapping and GIS

Before talking about mapping and landownership, there are several important concepts and terms to know:

- Mapping – The process of representing and communicating information as a map.

- Geographic Information Systems (GIS) – A digital database containing geographic data, combined with software tools for managing, analyzing and visualizing the information. It connects data to a map, integrating location data (where things are) with all types of descriptive information (what things are like there).

- GIS layers – The contents of a map broken down into relatable and distinct sets of information. Layers may include photos, street layouts, ownership patterns, and community water/sewer lines.

- Spatial awareness – Knowing where something is in relation to objects or locations on a map or in the real world.

- Spatial data – Any data that directly or indirectly references a specific area or location in the world (sometimes referred to as geospatial data).

What do mapping and GIS do for me?

We use maps and GIS information more than we may realize. For example…

- Most people have used a computer and their phone to get directions from one place to another.

- During election season, we are shown which counties or states are voting for specific candidates.

- Landowners can also use maps to find the specific location of their Indian lands on the reservation and in the community.

- The Land Buy-Back Program for Tribal Nations ensured that landowners had access to maps to help them decide whether to sell or hold onto their property.

- Private consolidation efforts and agricultural leasing are enhanced when given greater visibility through maps and GIS data.

- Economic development planning usually requires the use of overview maps of landownership, which include natural features like wetlands or mountain slopes.

- Tribal developments are usually communicated to the community by showing construction drawings placed on the land.

Tribes, business and landowners can take advantage of the way information (data) is communicated with modern mapping solutions. Village Earth, in partnership with ILTF, developed the Native Land Information System (www.nativeland.info) to quickly and conveniently provide publicly-available census and agricultural data to users. Tribal leaders, ag producers and landowners can use this public information by seeing it layered over conventional community maps. Farmers and ranchers can use online mapping to evaluate soil conditions, see crop coverage over time, and even more handy, these business owners can look at the relationship between location and valuation of the land.

Although it may have less immediate impact, there are many other increasingly common uses of geospatial data in our everyday lives. Mapping gives people information to better understand the climate and political changes happening in real time. This evidence allows us to make decisions that work in our own interests.

With so many different ways to use geographic data, the mapping skills and GIS knowledge involved are vital skills to have for anyone working on Indian land issues.

Additional Resources

- What is GIS? [ESRI]

- Google Maps and Google Earth [Google]

- QGIS – Free, open-source GIS software

- ArcGIS Online – Fee-based professional online GIS software [ESRI]

- Native Land Information System: (www.nativeland.info) – Includes curated dashboards, thematic maps, interactive story maps, and data portal connecting public information to U.S. geographic locations.

- Ag Census Web Maps – USDA (National Ag Statistics Service)

———————-

May 20, 2022

The Basics of Do-It-Yourself Estate Planning

Owning assets is usually pretty straightforward, but Indian landowners do need a written plan (a will) after death to determine who will receive the assets acquired from a lifetime of hard work. This short primer is designed to help landowners understand some of the issues involved in preparing a will.

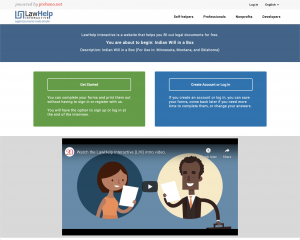

Arranging for the future of trust and personal assets for the end of life can be both complex and stressful. The Indian Land Tenure Foundation (ILTF) developed a simple way for individuals to deal with basic estates on their own. Called Will in a Box, the free online will writing tool meets the needs of Native Americans with trust and restricted-fee assets. Whether landowners want to do their own will writing (known as ‘Pro Se’) or use Will in a Box as a way to get ready to work with a team of estate planning professionals, the online will is a helpful way to get started.

Understanding Wills and Estates

The importance of a will for Indian landowners can’t be overstated. The more understanding landowners have of probate and the issues involved in writing a will, the better prepared they will be to leave the legacy they worked so hard to build and protect during their lifetime. Throughout Indian Country we hear landowners say things like, “I don’t have much, why should I write a will?” The answer is simple: Dying intestate (without a will) while owning trust or restricted-fee land is a recipe for giving away sovereignty to the federal government. The absence of a will may also cost loved ones time (often three or four years or even longer) before they can use the land. Making an estate plan is worth the time it takes, and taking that time is a small price to pay to take care of family.

A well-designed estate plan is a written place to document:

- Who should receive Indian assets

- Who should receive non-Indian land

- Who should receive cash

- Share wishes on care for minor or incapacitated children or grandchildren

- Eliminate doubt about healthcare decisions (living will or advanced directive)

- Provide direction on what to do with digital assets (social media accounts, digital photos in the cloud, email, and access to online financial accounts like PayPal or Etsy)

Will-in-a-Box

Should you write your own will? Although ILTF strongly recommends using knowledgeable professionals during the estate planning process, Will in a Box meets the basic needs of Native Americans with trust and restricted-fee assets. Will in a Box reduces some of the obstacles to writing wills, such as lack of money or opposition to working with attorneys. It also helps Indian landowners answer important questions and organize information to include in a valid will.

The estate planning checklist linked below will help landowners to collect information needed to get started. The Will in a Box questionnaire takes about an hour and once completed users can save, print and email the draft will document. The printout includes simple instructions and a will for signatures by the testator (person whose will it is) and necessary witnesses.

Will in A Box not only serves to deliver a legal will in some states, it walks all landowners through the decisions and steps critical to planning for the transfer of assets from one generation to the next.

Additional Resources

Will In A Box [Hosted at Law Help Interactive]

Estate Planning Checklist [ILTF]

Message Runner #2: A primer on Indian estate planning and probate

Message Runner #5: Cutting through the Red Tape

Will In A Box demonstration video [MLSA on YouTube]

Estate Planning Providers

- American Indian Wills Clinic at the Oklahoma City University Law School

- (405) 208-5017

- americanindianwillsclinic@okcu.edu

- Arizona State University – Sandra Day O’Connor College of Law

- Dakota Plains Legal Services

- (605) 856-4444

- Montana Legal Services, Inc

- Native American Program – Legal Aid Services of Oregon

- (503) 223-9483

- Oklahoma Indian Legal Services

- (800) 658-1497 (in State Only)

- oils@oilsonline.org

- Stewards of Indigenous Resources Endowment

- (866) 639-5550

- https://www.indianwillsonwheels.org/contact.php

___________________________

April 19, 2022

The Basics of Owner-managed Interest Leasing

As long as the federal trust responsibility exists, the ability of landowners to exercise their rights on their Indian land will be limited. Agricultural leases do offer one opportunity that was included in the American Indian Probate Reform Act (AIPRA) in 2004. Referred to by some as the “family farm lease,” the principle of owner-managed interest (OMI) is that landowners can organize to take advantage of their land on their own terms.

The purpose of 25 US Code Section 2220: Owner-managed Interests is simple: To provide a means for the owner or co-owners of trust or restricted interests to enter into surface leases without the specific approval of the United States Secretary of the Interior. As usual with Indian land, however, the realities can be a little more complex.

Important information to know

There is no regulatory framework for implementation of owner-managed interest status. Without clear executive instruction, Indian landowners are left to deal with a patchwork of processes that vary from region to region.

The application listed below is not directly offered by the Department of the Interior, the brochure cited is not available on the Bureau of Indian Affairs (BIA) website, and there is no standard owner-managed lease form. These steps are a set of best practices and/or are described in the law itself:

- Requires applications for owner-managed status (OMS) be submitted and signed by ALL landowners

- These applications for OMS do require approval from the Secretary of the Interior. (Once obtained, the individual leases do not require Secretarial approval.)

- Only for agricultural leases (NOT for mineral extraction)

- Lease also requires signatures by ALL landowners

- Lease term may not exceed 10 years

- Lease revenue collection and accounting is a responsibly of the landowners (No longer a Secretarial responsibility)

- Lease compliance is a responsibility of the landowners (No longer a Secretarial responsibility)

- OMI leases must be recorded by the Land Title Records Office

- There is no specific term that ends the OMI status

- Revocation will not end any current leases on the trust or restricted interest parcel

- An Indian tribe with jurisdiction over the land where the parcel is located maintains that jurisdiction

- Persons leasing and using the land consent to the tribe’s jurisdiction

- Gift deeds, sales, wills and intestate probates will require the OMI status to be renewed to ensure ALL landowners approve

Landowners need to remember that they have a right to end their participation in the OMI leasing process by submitting a letter of termination. While the law contemplates that regulations will be created for this rule as well as the broader law, the Department of the Interior has yet to publish any related regulations.

Additional Resources

- Message Runner #9: Managing Indian Land in a highly fractionated future

- 25 US Code 2220: Owner-managed interests [as published by Legal Information Institute]

- Owner Managed Interest Brochure (U.S. Department of the Interior)

- Application for owner-managed interest (U.S. Department of the Interior)

Feb. 9, 2022

The Basics of Indian Realty

Begin with the basics. Given the complex nature of the laws and regulations regarding Indian land, it’s important for landowners to have a firm grasp on the basic building blocks before tackling the transactions and processes involved. This primer should help Indian landowners learn more about how to make the most of this unique asset that is so valuable to families and tribal economies.

Let’s begin with the legal differences between land, real estate and realty, three terms that are used a frequently when discussing Indian land:

- Land – The earth’s surface to the center of the earth along with the air space above the earth, including natural features like trees and water

- Real estate – Land plus permanent human-made additions like buildings and fences. (This was legally changed by Congress for Indian lands and will be discussed below.)

- Realty – Also known as Real Property, realty is real estate plus a bundle of legal rights of ownership

GOVERNING JURISDICTION

In its simplest form, ‘jurisdiction’ is the exercise of sovereign authority by a government over territory within its national borders. Government laws establish the structures of what can be legally done on/with private land and also create either opportunities or obstacles for landowners to reach their goals. Two applications of civil jurisdiction used by the government over landowners are property taxes and zoning regulations. Here is a general list of land tenure and jurisdiction issues that landowners may need to consider in using land in a reservation community:

- Tribe

- Bureau of Indian Affairs (BIA) (Federal)

- Allotment landowner

- Tribal member

- Non-Indian

- State

- County

- Town/City

Concurrent jurisdiction is common throughout Indian Country. With shared authority, one government entity may have supreme jurisdiction over the other. When dealing with Indian land issues it’s important to understand the case law governing a given situation. When a question of appropriate jurisdiction occurs, and there isn’t clear agreement between governments, the two parties often end up pursuing their sovereign interests in court. (Scroll down to the resources posted on Jan. 17, 2022, for a more thorough discussion of case law.)

PROPERTY TYPES

The first issue to cover for property types in Indian Country is ‘title’ which has two meanings: 1. Evidence of ownership by a deed or 2. Ownership of the land as represented by the owner’s bundle of rights.

- Fee – The title holder is entitled to all rights to the property. These rights are usually limited only by public and private restrictions, such as zoning and restrictive covenants. When the landowner dies, the rights to the land pass to the owner’s heirs. In the context of Indian lands, the owner has the right to encumber (assign the property rights) or sell the property without federal interference.

- Restricted Fee – Title is held by the tribe or individual Indian landowner, subject to restrictions. Those rights limit the ability of the landowner to encumber or alienate the land without federal approval.

- Trust – Title is held by the United States government for the benefit of the tribe communally or for an Indian individually. All rights bestowed by title belong to the federal government. Beneficial owners face restrictions on the use of any bundled right without federal approval.

Congress used statutory law in 2008 to change the nature of Real Estate to address a federal problem with environmental contamination and remediation. Through the Act, permanent improvements are no longer considered trust assets. Click here to see a pdf version of the Permanent Improvements PowerPoint presentation.

Another key issue with trust land is the direct beneficial ownership form. Beneficial title is held by individuals as joint tenants or as tenants in common. Both provide the owner with the right to use or make decisions for the whole property, not just a specific piece of it. Click here to see a pdf version of the Joint Tenancy PowerPoint presentation.

BUNDLE OF RIGHTS

The Bundle of Rights is a concept in realty that is derived from old English law. A key concept of that law allowed rights to be separated and transferred individually or used by a landowner. The person, people or government who hold title to the real estate also owns these rights.

- Right of Possession – The right to use the property

- Right to Control – The right to do with the property as you wish

- Right of Enjoyment – The right to benefit from your property as long as you are not doing anything illegal

- Right to Exclusion – The right to keep others from entering your property

- Right of Disposition – The right to sell, devise (a will) or encumber (lease or easement) the property.

For a longer discussion of the Bundle of Rights, as well as information on the major differences of those rights for Indian land, please click the PowerPoint presentation below. [Bundle of Rights PPT]

Click here to watch a video of ILTF’s Realty 101 Town Hall recorded on Feb. 22, 2022

Additional Resources

- Message Runner #1: An overview of the major Indian land tenure issues

- Tribal Lands: An Overview [a publication of the Congressional Research Service]

- Bundle of Rights presentation (a pdf version of the PowerPoint presentation)

———-

Jan. 17, 2022

Statutes, Regulations and Case Law basics for landowners

Sometimes it seems like landowners need to be lawyers to understand all of the rules and regulations involved with owning and managing Indian land. The legal environment surrounding Indian lands is certainly complex, but there is some basic background information that will help landowners with the overall framework. This brief is meant to provide that information to help landowners better understand how the laws, regulations and court cases covering Indian land determine what they can do with their trust and restricted-fee assets.

What is the difference between the statutes, regulations and case law?

Conversations about land transactions in Indian Country often refer to CFR – the Code of Federal Regulations. It is critical to know the regulations since they lay out the operational processes the Bureau of Indian Affairs (BIA), landowners and users of Indian land have to follow. But before regulations are created, Congress passes legislation (statutory law) that spells out the legal rights and power of parties to transactions. Education on these laws can help landowners to determine if their rights are being protected in the processes spelled out by regulations. Finally, case law (court decisions) determines among competing federal, state and tribal interests what rights each government has in the overall legal environment. That authority then spells out limitations or opportunities covering the rights of landowners.

Statutes: Enacting the law through a deliberative process

Statutory law can also be called an ‘act’ such as the Dawes Act of 1887. Also known as the General Allotment Act, the Dawes Act is the legislation that led to Indian people having beneficial ownership of land today. The land in more than 175 tribal communities was divided into individual allotments for tribal citizens. Some 135 years later, fractional ownership still exists as a result of this law which stated that land protected under its language could not be alienated from the tribal community. Allotments were ended and tribal communities were reorganized under the umbrella of the Indian Reorganization Act of 1934 and the Oklahoma Indian Welfare Act of 1936. Both of these statutory laws spell out who may own Indian land and for what reasons.

There are three other important acts which serve as the basis for the regulations covered in subsequent paragraphs:

- The Act of February 5, 1948 for granting rights-of-way across Indian lands

- The Long-Term Leasing Act of 1955 for land leases

- The American Indian Agricultural Resource Management Act

Regulations: Creating rules for executive action

Regulations are used by various federal and tribal administrations to enact policy goals such as leasing of land and extraction of mineral resources. A regulation is an official rule to control conduct within specific areas of responsibility. Earlier publications in this series discussed regulations related to agriculture leases (25 CFR Part 162 – Subpart B) and rights-of-way (25 CFR Part 169); and more broadly, leasing regulations are covered under Part 162 as a whole.

Regulations are used by the BIA to process land transactions and should be consistent across all agency offices. The regulations describe how landowners can exercise and protect their rights, and it’s important for landowners and agricultural producers to understand how the laws and regulations in Indian Country can impact them. (See links below to the various regulations)

Case Law: Interpreting the law through the courts

Case law is based on judicial decisions rather than constitutions, statutory law or regulations. Case law concerns unique disputes resolved by courts using facts of the case. Understanding case law is usually the weakest part of a landowner’s knowledge base, but it can sometimes be the most important piece of the puzzle for maximizing the benefits of landownership. It is critical to recognize that there are more courts that have an impact on tribal land than just the U.S. Supreme Court (SCOTUS).

The reason the Supreme Court carries so much weight in conversations of Indian land is that adjudicated issues can be applied across the board for all affected tribes. To illustrate the impact of case law on Indian land ownership, we have included cases from the Supreme Court, the Sixth Circuit Court of Appeals, Internal Revenue Service and the Interior Board of Indian Appeals (IBIA)

Below are some common issues from the landowners point of view that often arise. Links to the related cases are included in the Additional Resources section.

- “As long as I own my trust land, neither the feds nor the state can tax the revenue proceeds from my cows, corn, oil, etc.” – See Revenue Ruling 67-284

- “The county cannot tax the mobile home I live in on my tribal lease.” – See Bryan vs. Itasca

- “The state cannot even tax my fee property on the reservation.” – See Keweenaw Bay Indian Community vs. Naftaly. (This is a specific case which is included here because it illustrates that until the Supreme Court rules on a case, similar tribes using the same treaties may not receive the same judicial ruling. The Lake Superior Chippewa Tribe covers separate Bands that hold reservation land in three different states meaning they are under the jurisdiction of three different U.S. Circuit Courts of Appeals.)

- The eastern half of Oklahoma is Indian Country again. – See McGirt vs. Oklahoma

Additional Resources

- American Indian History Timeline – The updated timeline illustrates events, policies legislation and laws relating to Indian land tenure from 1598 to the present.

- Message Runner #4 – From Removal to Recovery: Land Ownership in Indian Country

- Message Runner #6 – Native Land Law: Can Native American People Find Justice in the US Legal System

Statutory Law

- Dawes Act (General Allotment Act of 1887)

- Wheeler-Howard Act (Indian Reorganization Act)

- Oklahoma Indian Welfare Act

- Public Law 108-374 (American Indian Probate Reform Act)

- 25 U.S. Code Chapter 24 Indian Land Consolidation

Regulations

- 25 CFR Part 162 – Leases and Permits

- Subpart A: General Provisions

- Subpart B: Agricultural Leases

- Subpart C: Residential Leases

- Subpart D: Business Leases

- 25 CFR Part 169 – Rights-Of-Way Over Indian Land

Case Law (Cases are from the Supreme Court unless specifically noted)

- Revenue Ruling 67-284 [Internal Revenue Service] – Non-tax of income derived from Indian land

- Bryan vs. Itasca County – Civil jurisdiction of tribes over their members (excludes state taxation)

- Brendale vs. Confederated Yakima Indian Nation – Tribal authority/exclusive jurisdiction over non-Indian property within a “closed” reservation

- Keweenaw Bay Indian Community vs. Naftaly (Township of L’Anse) [Sixth Circuit Court of Appeals] – State lacks authority to levy property taxes on Indian-owned land even if in fee simple

- Carcieri vs. Salazar – Secretary of Interior may only take land into trust for tribes recognized in 1934 (now under federal jurisdiction)

- McGirt vs. Oklahoma – Although in connection to death penalty/capital punishment, case asserts that Muscogee Creek nation (and other Five Tribes) were not disestablished

- Shawano County, WI vs. Acting Midwest Regional Director, BIA [Interior Board of Indian Appeals] – Affirmed trust acquisitions on behalf of the Stockbridge Munsee Community

Click here to watch a video of the Impact of Laws, Statutes and Regulations Town Hall recorded Jan. 25, 2022.

———-

Nov. 17 Town Hall: Landowner Knowledge, Skills and Abilities

Resources

Important landowner rights:

- Assorted Indian Land Consolidation Act (Assorted section)

- Owner-managed Interests (Section 222)

- Real Estate 101 Presentation

———-

Sept. 14, 2021: Agricultural Leasing for Landowners and Native Producers

Unchanged for too long, the federal process for ag leasing in Indian Country has transformed over the last 25 years to give tribal communities the ability to set their own goals and ground rules for agriculture. This brief overview should lead landowners and producers to basic information on statutes and regulations, and help them to exercise their power in managing Indian lands to meet their communities’ needs.

How does the process work?

The process for leasing agricultural land involves several steps, including these primary ones:

- Pre-Lease Activity

- Identification of lands available for lease

- Lease Preparation

- Negotiated Lease Preparation

- Receipt of negotiated lease

- Review of document for compliance with all applicable regulations

- Lease Preparation from an Advertised Sale

- Advertising of available lands

- Conducting the lease sale

- Preparation of draft lease

- Lease Amendment, Assignment and Sublease

- Approval of the lease

- Issuance of the lease

- Recording of the lease

- Lease Administration

- Processing of any subsequent amendments, assignments, subleases and other leasehold documents

- Lease Compliance

- Monitor leases for financial and land use compliance

- Issue notice(s) to correct any provisions of the lease that have been violated

- Terminate or cancel the lease and evict if violations remain uncorrected

- Negotiated Lease Preparation

The process places a lot of authority in the hands of the tribe if they actively manage their lands through agricultural land planning and the creation of appropriate laws and regulations. The more landowners and ag producers know, and the more they are involved, the greater their power to ensure their rights are represented during the development of a local legal framework.

Leasing: The Law

The Early Days: The legal environment was put in place more than 50 years ago by the Long-Term Leasing Act of 1955. This law is found in U.S. Code 25, Chapter 12 – Lease, Sale, or Surrender of Allotted or Unallotted Lands – and Section 415 specifically deals with the Lease of Restricted Lands. Most of the original policies and procedures set the tone for how Indian lands would, and often continue to be, managed.

The American Indian Agricultural Resource Management Act (AIARMA): In 1993 Congress passed the AIARMA, which changed several existing rules for leasing. Coming about during the age of the Cobell litigation, BIA emphasized accountability and deference to landowner needs and the sovereign authority of tribes. The primary changes to ag leasing laws had the following impact:

- Bureau of Indian Affairs (BIA) must recognize and enforce tribal laws and regulatory ordinances

- Requires that federal land management activities conform to tribal management plans

- Establishes a maximum lease term of 10 years but…

- Continues a maximum of 25 years for ag leases that require a “substantial investment”

- Regardless of lease length, rent adjustments are required at least every five years

- Simple majority consent of landowners on allotted lands

- Written objection by majority ownership of allotted lands to certain tribal leasing policies (e.g. tribally-established rental rates) may exempt the property from those rules before a lease is granted or approved

- Legally adopted the “best interest” and “market rent” standards

The Helping Expedite and Advance Responsible Home Ownership Act (HEARTH): The HEARTH Act gave even greater deference to tribal governments in leasing. The Act governs residential leases but also enabled tribes to provide greater direction on business and agricultural leasing. One of the most significant reasons for tribes to adopt HEARTH Act laws and regulations is the ability to approve leases without the BIA. The HEARTH Act only applies to tribal land leases but DOES NOT affect allotted lands.

The HEARTH Act provides a road map for adopting this type of ordinance. Included in the resources section below is the Agricultural Leasing Code of the Ho-Chunk Nation, which offers an example of what a tribal community can do under this federal law.

Ag Leasing: The Regulations

The Agricultural leasing regulations required by AIARMA were approved and published in 2001. (Updates are found in CFR 25, Part 162 – Subpart B.) The separation of agricultural items from the rest of Part 162 was designed to bring greater clarity. Among the highlights from Subpart B are the following:

- Fully documented “form” leases must be processed within 30 days of receipt

- The rights of an owner in possession of the property are balanced against all other owners by granting the possessory owner a Right of First Refusal in the event of a negotiated lease

- Although rent adjustments are required by the law, the regulations are silent on the issue, leaving the time and manner of adjustment to be specified in each lease

- All ag leases must be recorded

- BIA is required to respond in situations of non-payment violations and is authorized to assess late fees and pursue pre-cancellation collections

- Authorizes emergency actions to protect the ag resource as needed to address holdover, unauthorized use, and resource damages

Greater detail on these issues can be found in the resources listed below, including the AIARMA presentation, the Agricultural Leasing Procedural Handbook, and the Agricultural and Rangeland Management Handbook.

Additional Resources

Click the links below to access more helpful resources.

- U.S. Code 25, Chapter 39 – American Indian Agricultural Resource Management Act

- CFR 25, Part 162, Subpart B – Agricultural Leases

BIA Ag Resources

- AIARMA and BIA Ag Leasing and Permitting Regulations (November 2016 presentation)

- Agricultural Leasing Procedural Handbook (March 6, 2006)

- Agricultural and Rangeland Management Handbook (July 14, 2021)

HEARTH Act Overview

- BIA: HEARTH Act of 2012 website

- BIA National Policy Memorandum: Guidance for the Approval of Leasing Regulations under the HEARTH Act

- Ho-Chunk Agricultural Leasing Code

———-

August 10, 2021: Rights-of-Way Basics for Landowners

There are roughly eight distinct steps in the federal rights-of-ray process in Indian Country, two of which are usually of primary concern for landowners trying to protect their interests. This brief should provide landowners with basic information on the topics of Consent and Valuation, and help landowners to exercise their power in managing their Indian lands during the rights-of-way process.

How does the process work?

The process involves several steps and always begins at the Bureau of Indian Affairs (BIA). These are the primary steps:

- Obtain the Title Status Report (TSR)

- Names, addresses and ownership percentage of landowners

- Submit an application to the BIA

- Location, purpose and duration of the ROW

- Valuation report

- Obtain or grant consent

- Procure bonding for the project (an insurance for performance of agreement terms)

- Environmental and archeological reports

- BIA approval

- Execute and record the right-of-way

- Compliance and enforcement

The process places a lot of authority in the hands of the BIA. The more landowners know, and the more they are involved, the greater their power to ensure their rights are represented during negotiations.

Rights-of-Way: The law

The Act of February 5, 1948 is the primary authority for granting rights-of-way across Indian land as codified in statutes as U.S. code 25, chapter 8 and includes sections 311 to 328. These sections address various types of rights-of-way and establish ground rules for acting on uses of land. Landowners should pay attention to two sections in particular as they affect Indians’ rights on Consent and Compensation. Section 325 grants all authority to the Secretary of the Interior to determine “just” compensation. Section 324 lays out the rights the Secretary has to grant consent:

- Simple majority of landowners

- Whereabouts Unknown

- Undetermined heirs if there is no substantial injury is caused by the grant

- More than 50 landowners (highly fractionated title) if no substantial injury is caused by the grant.

Rights-of-Way: The regulations

Code of Federal Regulations (CFR) 25, part 169 addresses the process through which the BIA details, administers and enforces the rules of rights-of-way. Various sections cover purpose, definitions and general provisions in obtaining a right-of-way. The issue of compensation to landowners is covered in sections 110-122.

- Section 112 covers individually allotted lands:

- Amount of compensation that must be paid

- Does not limit how much may be requested/demanded

- Makes special exception for utility cooperatives and tribal utilities

- Section 113 requires compensation reviews every five years

- Section 114 covers Fair Market Value

- Valuation is determined by:

- Market analysis

- Appraisal

- Other appropriate valuation methods, such as those used by oil and gas or utility companies

- Department of the Interior (DOI) must either prepare or approve the valuation.

- Valuation is determined by:

Other Issues

The American Indian Probate Reform Act (AIPRA) was passed in 2004 and contains a section that changes the consent process for leases, rights-of-way and sales of natural resources on allotted lands. Referred to as the “sliding scale,” U.S. code 25, chapter 24, section 2218 increases the percentage required to act from simple majority to a higher level as the number of landowners decreases. For example, if there are 6-10 owners 80 percent ownership approval rate is required, but 11-19 owners requires only 60 percent. DOI explained that they would follow earlier rights-of-way law in protecting and preserving tribal sovereignty to grant or deny consent regardless of their ownership percentage if they are a co-owner in a parcel with Indian individuals (final rule 11/19/25). The regulation is an interpretation of the law and demonstrates that landowners may have rights not captured in the regulations. At the same time, it might help landowners to stop a federal action they disapprove of. Information on pipelines can be reviewed in U.S. code 25, chapter 8, section 321. To learn more about throughput valuation in the regulation go to page 72514.

Additional Resources

Click here to watch a video of the Town Hall on rights of way

Click the links below for more information:

- Message Runner #8 – Appraisals 101: The realities of valuing Indian land

- 25 US Code Chapter 8 Sections 311-328 Rights of Way Through Indian Lands

- 25 CFR Part 169 CFR

- BIA Rights of Way

- Information Page

- Rights of Way on Indian Land; Final Rule 25 CFR Part 169 2015 Final Rule Rights of Way Regs

- Final Rule FAQs

- Appraisal of ROWs Memo 6-20-2019

- AVSO Overview

———-

July 14, 2021: Probate Basics for Landowners

Probate is a complex legal process governed by tribal, federal and state laws and regulations that spell out the roles and responsibilities involved in distributing an estate. Depending on the person’s assets, two probates may be required: one state and the other federal as described below. It can take two years or more to complete an Indian probate so it’s important for landowners to know the rules and processes involved.

There are two separate agencies at the Department of the Interior (DOI) involved in the probate of Indian land: The Bureau of Indian Affairs (BIA) and the Office of Hearings and Appeals (OHA). The BIA’s Division of Probate gathers information about the decedent (the person who died) and his or her family and property and prepares it for adjudication. OHA judges are in place to ensure that individual Indian trust assets are conveyed to the rightful heirs and beneficiaries according to the appropriate probate law. After OHA issues a probate order, the Division of Probate works with other trust offices, such as the Bureau of Trust Funds Administration and the Land Titles and Records Office, to distribute the assets.

There are two separate agencies at the Department of the Interior (DOI) involved in the probate of Indian land: The Bureau of Indian Affairs (BIA) and the Office of Hearings and Appeals (OHA). The BIA’s Division of Probate gathers information about the decedent (the person who died) and his or her family and property and prepares it for adjudication. OHA judges are in place to ensure that individual Indian trust assets are conveyed to the rightful heirs and beneficiaries according to the appropriate probate law. After OHA issues a probate order, the Division of Probate works with other trust offices, such as the Bureau of Trust Funds Administration and the Land Titles and Records Office, to distribute the assets.

12 Steps to a Federal Probate

DOI published a guide called Your Land Your Decision – What is Probate? to explain specific probate issues in detail. This online document provides regulatory references along with steps in the process.

- An American Indian/Alaskan Native passes away

- Family of the deceased notifies the BIA

- BIA Agency/Tribal Probate verifies the decedent owned trust property at time of death

- BIA Agency/Tribal Probate requests information/documentation from surviving family members

- BIA Agency/Tribal Probate receives all necessary documents and prepares a probate package that is forwarded to OHA

- OHA reviews the file and schedules a hearing or summary probate

- OHA conducts a hearing or summary probate and issues a written decision

- Parties adversely affected by the decision may request a rehearing within 30 days of the mailing

- The Judge rules on the decision for rehearing, establishing another 30 days for appeal

- If no interested parties file a request or appeal within that 30-day window…

- BIA and Land Title Records Office (LTRO) changes land records in accordance with the final decision.

- OST pays claims and distribute funds in accordance with the final decision

Who starts the process?

Many families assume the BIA starts the probate process. That’s incorrect. To start the process a family member needs to contact the BIA agency where the decedent was enrolled and inform them of the death and send a certified copy of the death certificate.

If everything goes smoothly, the probate process could take 12 to 14 months to complete, but it often takes much longer with the document collection, appropriate notices, and hearings involved. The better-prepared families are with documentation, including having a valid will, the quicker the process is likely to take.

What information/documents needed for the Division of Probate?

- Death certificate

- Social Security number

- Tribal enrollment number

- Names, current addresses and tribal enrollment numbers of potential heirs and devisees

- Marriage and divorce records

- List of aliases or name changes

- Wills, revocations and codicils (amendments to the will)

Proposed regulatory changes

The American Indian Probate Reform Act (AIPRA) became law in 2004 and it affects all probates for those who passed away after June 2006. In 2016 and 2017, the BIA sought input on how the probate process was working. Through evaluation of public comments and examination of current regulations, DOI identified 13 proposed changes to improve the process and administration of probate for Indian people. The proposed changes listed below will likely have the most impact. (Click here to access the Federal Register containing the entire list of proposed changes.)

- Overly burdensome “Purchase at Probate” process – The probate must remain open indefinitely during the purchase, and a final decision cannot be issued for the remainder of the estate. The change would allow the case to close by providing certainty to buyers of interests the potential heirs/devisees agree to sell.

- Increase opportunities to use “Renunciation” to maintain trust status of property – The proposed rule would allow individuals additional time to renounce their rights to prevent the property from going out of trust.

- Reopening closed probate cases – Changes would limit both the number of rehearings an interested party may petition and make clear the circumstances under which new evidence may be submitted.

- Streamlining process for small estates – The proposed rule would increase the scope of estates that would be eligible for summary administrative decision without a formal hearing. This would affect estates with only cash of less than $300 and holding NO land.

- Descent of off-reservation lands – Current regulations do not address descent of Indian lands located outside the boundaries of a reservation and are not subject to the jurisdiction of a tribe (such as certain public domain lands).

Definitions

- Assets – Property owned prior to death that has monetary value. In BIA Probate, assets include trust lands and monies held in Individual Indian Money (IIM) accounts.

- Beneficiaries – Individuals who inherit property from an estate by will or intestate. Beneficiaries are different than heirs (see below).

- Decedent – The person who died.

- Estate – The real and personal property that a person possesses at the time of death that passes to heirs or testamentary beneficiaries.

- Heir – A person who is eligible to receive property from an individual who dies without a will (intestate).

- Probate – The process of identifying and distributing the decedent’s estate.

- Will – Document that describes how an individual wishes to have their property distributed after death. Wills must be formally executed according to law applicable in the jurisdiction where the will is made.

Additional Resources

Message Runner #2 – A primer on Indian estate planning and probate

CFR 25, Part 15 – Probate of Indian estates except for members of the Osage Nation and the Five Civilized Tribes

Proposed regulatory changes for AIPRA (Federal Register 1/7/2021)

Probate Process for Native Americans – California Indian Legal Services (7/2012)

Office of Hearings and Appeals

———-

June 8, 2021: Appraisal Basics for Landowners

Nearly every land transaction in Indian Country requires an appraisal (valuation) of the land and/or its resources. The U.S. Department of the Interior (DOI) uses those values in processing applications for sales, leases, rights-of-way, land exchanges, trespass, probate, and other types of transactions. The time it takes to complete an appraisal can make or break a transaction, so it’s important for landowners to know the rules and processes involved in the appraisal and valuation of Indian land.

In June 2016, Congress passed the Indian Trust Asset Reform Act (ITARA) which made three major changes that affect the valuation of Indian lands:

- A single office of Appraisal and Valuation Services Office (AVSO) was created to administer the appraisal process.

- Minimum qualifications were established for individuals to prepare appraisals and valuations.

- A process was developed to waive review or approval by DOI when a valuation is conducted by a qualified appraiser.

Critical issues

Landowners should be aware of a number of critical issues with Indian land appraisals which are outlined below.

Appraisal Request Process – The process always begins at the Bureau of Indian Affairs (BIA). A landowner or party interested in using or buying Indian land will need to discuss their request for an appraisal with BIA staff, and will need to submit the appropriate transaction application (sale, lease, etc.). Other documents may also be required, including:

- Land Title Status Report

- Survey

- Probate order

- Tribal authorization

Appraisal Review Waiver – The Waiver rule requires the Department to forego review and approval of the appraisal or valuation and consider the appraisal or valuation final if three conditions are met:

- The appraisal or valuation was completed by a qualified appraiser

- The Indian tribe or individual Indian expressed their intent to waive DOI review and approval at the same time as the transaction request

- No owner of any interest in the property objects to the use of the appraisal or valuation without DOI review and approval.

There are exemptions for certain kinds of transactions that still require Departmental review, including the Land Buy Back Program, purchase at probate, and for acquisitions by the U.S. government such as fee-to-trust. (Appraisal Waiver Package Checklist)

Using an Outside Appraiser – When an appraisal is conducted by AVSO, it can take months or even years for landowners to receive an appraisal report. Landowners can speed up the process by using their own appraiser. Please be aware of some key issues before heading down this road.

- First, the funds to pay the outside appraiser are your responsibility. Once the landowner chooses to go outside of the DOI process they also agree to pay the appraiser’s fees which will likely be required in advance.

- Seller(s) must agree to the appraisal valuation. If any seller disagrees with the value they will likely refuse to sign the waiver application.

- Waiver applications that don’t have the appropriate signatures will automatically be denied.

- Without Interior approval or an accepted waiver, the transaction will die.

Important definitions to know

Appraiser – One who competently performs the valuation services in an independent, impartial, and objective way.

Appraisal – The act or process of developing an opinion of value.

Fair Market Value – An opinion of what a property would sell for in an open and competitive market, and a what a ready, willing and able buyer might pay for a property in the current market.

Highest and Best Use – Highest and best use is about what the land could be used for, not what it is being used for right now. In order to be considered the highest and best use the value must meet four criteria: Be legally permissible, physically possible, financially feasible, and appropriately supportable by the current market.

Sales Approach – Method of appraisal based on direct comparison of between the property being appraised and other properties sold or listed for sale in the area.

Income Approach – Appraisal method commonly used for commercial properties. Asks how much income the property can produce, including the proceeds of a future sale.

Cost Approach – Appraisal method that determines value by combining the value of the land with the cost to reproduce all of the improvements, less depreciation.

Site Specific Appraisal – An appraisal process that analyzes one tract of land at a time, based on physical and economic characteristics on the subject property compared to similar properties.

Mass Appraisal – Process used to value many properties that are similar in use (For example, dry crop pasture or vacant land) and have active/consistent markets or comparable sales data. The process uses common data, standardized methods and statistical testing and allows for greater efficiency and consistency in valuations.

Project Appraisal Report – A multiple tract appraisal report that includes the appraisal of more than one tract in a single report. The most relevant method of valuation is the same for all tracts and the report format follows the requirements under Uniform Appraisal Standards for Federal Land Acquisitions (UASFLA), Section 17-D.

Mineral Deposit – Identifiable geological occurrence of minerals of a size and concentration that may have the potential for economic recovery, now or in the future. Typical minerals may include oil, gas, sand and gravel. Mineral values are determined by the Division of Minerals Evaluation, a part of the Appraisals and Valuation Services Office (AVSO) within the Department of the Interior.

Additional Resources

Waiver of Appraisal Review

Indian Land Appraisal Webinar – On October 22, 2020 ILTF hosted a 90-minute webinar with Tim Hansen, Director, and Gregory Powell, Regional Supervisory Appraiser, from the Appraisals and Valuation Services Office (AVSO). The webinar explored changes to AVSO and looked at technical aspects of Indian land appraisals.

- ILTF webinar on appraisals

- Appraisals Webinar Presentation

- AVSO: Indian Trust Property Valuation Division website

AVSO Overview

———-

May 11, 2021: The Basics of Estate Planning

It is critical for Indian landowners to take the legal step of writing a Will to control their assets and avoid potential family conflict. But there is more that can be done to protect your health and your children, and ensure that your other wishes are carried out after you are gone. Understanding the basics of preparing a comprehensive estate plan can help Native people simplify the process of passing their land, personal property and significant cultural items on to the next generation.

Nobody can prevent death, but we can prepare for it. Proactive estate planning means being prepared, and having a Will is a good place to start. A comprehensive estate plan should include more than just your Will. A good estate plan will simplify the probate process and allow others to act on your behalf. The following resources Will not only provide you with information on how to take the next steps, but will briefly explain the different choices you can make in preparing your estate plan.

The Indian Land Tenure Foundation (ILTF) recommends seeking guidance from an attorney who is knowledgeable about Indian probate. Finally, you should also pay attention to the probate rules of your particular tribal nation, the state where you live, and the federal government because each of them can have an impact on your estate after you pass away.

Important Concepts for preparing your Will

Why do I need a Will? – Whether you are 80 years old or 18, there are many good reasons to have a Will. Having a Will may save you time and money, and ensure your peace of mind. It enables you to give your property to the people you want to have it after you are gone. And having a Will can make the probate process happen more quickly and more easily.

- Click here to watch a video on this subject.

Witnesses for a Will – When executing a Will, you will need at least two witnesses who should be unrelated to you. For example, siblings and other immediate family members usually stand to benefit from a Will and, from a legal standpoint, would not be the best witnesses. A court could potentially void your Will if the motivations of the witnesses seem questionable.

- Click here to watch a video on this subject.

Self-proving affidavit – The person who is making a Will (legally known as the ‘testator’) is highly encouraged to include an ‘attestation provision’ within the document. A ‘self-proving affidavit’ within a Will, authenticates the testator’s mental capacity as verified by the two signing witnesses.

- Click here to watch a video on this subject.

‘Joint tenancy’ or ‘tenancy in common?’ –‘Joint tenancy’ and ‘tenancy in common’ provide each owner with the right to use or make decisions for the whole property, not just a specific piece of it. ‘Tenancy in common’ is the most well-known form of trust property ownership. It retains the ability to sell your interest in the land, or leave it to someone in a Will, without the consent of any other owner. ‘Joint tenancy’ with the ‘right of survivorship’ leaves the shared interest in property to the last living heir. It is important to know the difference between ‘joint tenancy’ and ‘tenancy in common’ and to clearly state your wishes in your Will. If a Will doesn’t specify the situation, the judge is required by law to give the land to your heirs as joint tenants.

- Click here to watch a video on this subject.

Disinheriting a spouse – ‘Disinheritance’ is a tool you can use in order to specifically prevent a family member from inheriting property. Disinheritance of a spouse is controlled by state law and can be difficult to accomplish.

- Click here to watch a video on this subject.

Disinheriting a child – Disinheriting a child in a Will can be difficult, both for personal and legal reasons, but it can be done. Omitted heir statutes give rights to all heirs, whether they are named in the Will or not. If the child is disinherited incorrectly, it may give them a claim to a share of the estate. An omitted heir statute does not apply if the child was omitted from the Will intentionally and in writing.

- Click here to watch a video on this subject.

Other strategies to complete your estate plan

Why do I need an ‘advance directive?’ – An ‘advanced directive’ for healthcare is a legal document that offers an efficient way to clearly make your plans for health decisions known even if you are unable to do so during a medical emergency. An ‘advance directive’ will help your loved ones advise medical personnel and make decisions consistent with your wishes.

- Click here to watch a video on this subject.

Why do I need a ‘Power of Attorney?’ – A Power of Attorney (POA) is an essential legal document that enables the principal to grant either broad or limited powers to another party known as an ‘agent.’ Powers are specific to financial or legal matters and may include tax preparation and filing, investment account management, representation in lawsuits, etc. Power of Attorney can be granted immediately or once the principal becomes incapacitated.

- Click here to watch a video on this subject.

Probate avoidance – Transferring certain assets outside of probate can be easier and more timely than going through the probate process. Financial assets, such as bank accounts, retirement accounts, and life insurance policies, offer the opportunity for you to name a beneficiary to receive your money. If you leave that line blank, those assets have to go through probate so that a judge can determine who will receive those assets. Some states, such as Oklahoma, may also provide for the transfer of non-Indian real estate and motor vehicles. A knowledgeable attorney can discuss the possibilities available to you in your home state so that you can make informed decisions.

- Click here to watch a video on this subject.

Additional Resources

Estate Plan Preparation Checklist

Legal/document examples from Oklahoma

- Advanced Directive for Healthcare Brochure (Oklahoma Bar Association brochure)

- Advanced Directive for Healthcare Form (Statutory form)

- Power of Attorney (Statutory form)

- Transfer on Death documents

Will in a Box – A free tool available for American Indians who own trust land in Montana, Minnesota and Oklahoma. This online resource can be used to plan or even create your Will. Scroll down this webpage and look for Will in a Box resources.

Click here to watch the May 25 Town Hall Q&A session on the Basics of Estate Planning.

——————–

March 9, 2021: The Basics of AIPRA

Understanding the American Indian Probate Reform Act (AIPRA) is vital for Native people because it spells out what the U.S. government will do with an individual’s Indian land when they die. If landowners don’t want a judge to decide what happens with their land, they need to understand AIPRA and how it works.